How Would I Advise a Client With £1 Million to Invest?

- Mimi.O

- Sep 18

- 4 min read

Updated: Sep 19

Introduction

In one of my last posts, I looked at how I would invest £500,000 for a hypothetical client. That exercise was mainly about building a portfolio and thinking through asset allocation. In this post I want to take things further by imagining how I would advise a client who has £1 million to invest.

Having a clear investment strategy is important because it gives structure to decisions and helps avoid being influenced by short term market changes. With a larger sum like £1 million, the stakes feel even higher, which makes it important to balance growth with protection. The objective is still the same as before, to maximise returns while managing risk, but the advisory process becomes more detailed, and client focused.

Assessing the Client’s Profile

The first step would be to fully understand the client’s financial goals and timelines. Some goals might be short-term, like buying a home or funding education, while others are long-term, such as retirement planning. The timeline matters because it affects the level of risk that can be taken. Money needed in five years should not be exposed to the same level of risk as money that can stay invested for twenty years.

Risk tolerance is also crucial. Every client has a different comfort level with volatility. Some are prepared to accept sharp ups and downs in pursuit of higher growth, while others prefer steadier progress even if the returns are lower. There are also different types of risk to think about, such as market risk, interest rate risk, and inflation risk. Matching the portfolio to what the client can realistically handle is the foundation of good advice.

Diversification: Key to Investment Strategy

Once the client’s goals and risk profile are clear, the next step is to design a diversified portfolio. Diversification means spreading investments across different asset classes so that the portfolio is not dependent on one single area.

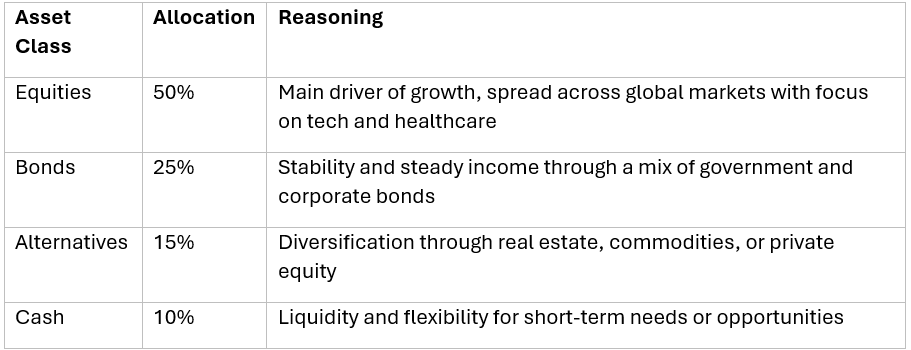

The main asset classes include equities, fixed income, real estate, and alternatives. For example, a balanced portfolio for this client might look like 50 percent equities, 25 percent fixed income, 15 percent alternatives, and 10 percent cash.

These numbers are not fixed, but they show how diversification can reduce risk and smooth out returns over time.

Investment Options to Consider

Equity Investments: Equities can be the growth driver of the portfolio. They carry more volatility but also more potential for long term gains. For this client, sectors like technology and healthcare could be worth considering because of their innovation and resilience.

Fixed Income Securities: Bonds provide stability and income. Government bonds are often seen as safer, while corporate and high yield bonds carry more risk but also offer higher returns. A mix of different types can help balance growth and safety.

Real Estate Investments: Property can bring both income and capital gains. The client might consider direct ownership or invest through Real Estate Investment Trusts to get exposure without the responsibility of managing property.

Alternative Investments: Alternatives such as hedge funds, commodities, or private equity can offer returns that do not always move in line with traditional markets. They can add resilience to a portfolio, though they also require careful research.

Tax Considerations

An important part of advising a client is to think about tax. Different investments are taxed in different ways. For example, equities may generate capital gains tax, while retirement accounts or ISAs may offer tax advantages.

Using tax efficient investment motors helps clients keep more of their returns. This is why tax planning is not just an extra step but a central part of an investment strategy.

Regular Monitoring and Rebalancing

A portfolio is not something that can be built once and left alone. It needs regular monitoring to make sure it is performing in line with the client’s goals. This includes reviewing performance, assessing whether the original assumptions still hold, and adjusting when needed.

Rebalancing is also essential. If equities do very well, they might grow to represent a much larger share of the portfolio than intended. This could expose the client to more risk than they wanted. Rebalancing brings the allocation back to its original balance and keeps the portfolio aligned with the agreed strategy.

Conclusion

Investing £1 million requires more than just picking a mix of assets. It means carefully assessing the client’s goals, understanding their appetite for risk, planning for tax, and designing a strategy that can adapt as markets and personal circumstances change.

For me, thinking through this scenario shows that good advice is about more than the numbers. It is about ongoing communication with the client, making sure they understand the trade-offs, and helping them stay on track with their long-term objectives.

Final Thoughts

Coming from a radiography background, I notice a lot of similarities between healthcare and finance. Both rely on detail, managing risks, and good communication. In radiography I used to explain procedures to patients, and in wealth management I would be explaining financial strategies to clients. Both situations require trust, empathy, and helping people make decisions that really matter. Thinking through this exercise has also shown me how unpredictable investing can be.

Markets are always changing, and every client will have different needs, so strategies have to stay flexible. As a student, this has been a useful way for me to practise both the technical side of building a portfolio and the human side of advising.

Comments